Setting Up a Business in Dubai - Your Ultimate Step-by-Step Guide

Dubai is a world-class business hub offering numerous benefits like 0% income tax, a central location connecting Asia, Europe, and Africa, and a progressing diversified economy.

Need help getting started? Shoot us a message today, and turn your big idea into a global success story.

All You Need to Know about Starting a Company in Dubai

We have created this guide to help you start your business as smoothly as possible in Dubai. We’ll guide you through each step, from choosing the perfect location to dealing with legal requirements and paperwork. You’ll be ready by the end to turn your business dream into reality in one of the most dynamic markets on the planet.

Table of Contents

- Setting Up a Business in Dubai – Your Ultimate Step-by-Step Guide

- – All You Need to Know about Starting a Company in Dubai

- – Types of Business Structures

- – Step-by-Step Guide to Setting Up a Business in Dubai

- – Financial Considerations

- – Legal and Regulatory Requirements

- – Cultural and Business Etiquette

- – Frequently asked questions

Why Dubai is Your #1 Opportunity for Business in 2025

Dubai and the UAE have transformed into global hubs for entrepreneurs seeking fertile grounds to grow their ventures. With a diverse workforce where roughly 88% of the population consists of expatriates, it’s clear this region is a magnet for dreamers and doers. The question isn’t why invest here—it’s why not?

There are some very compelling reasons why Dubai is the ultimate destination for your business venture:

1. Unstoppable Economic Growth

The IMF has projected that UAE’s economic growth will be 5.1% in 2025, outpacing global averages. The UAE isn’t just about oil anymore; its robust non-oil sectors are making up over 70% of the GDP. Industries like tourism, trade, technology, and construction are progressing, driving massive opportunities for entrepreneurs like you. Why settle for average when you can ride the waves of an economy sprinting forward?

Dubai and the UAE don’t just support businesses—they champion them. From pro-business regulations to incentives for foreign entrepreneurs, the system here is designed for your success. It’s more than an opportunity; it’s an invitation to build your empire among the world’s most ambitious entrepreneurs.

Stop waiting and start acting. Dubai is where businesses don’t just grow—they soar. Those who see the opportunity today will be the success stories of tomorrow. Will you be one of them?

Types of Business Structures

Overview of Business Structures in Dubai

1. Mainland Businesses

2. Free Zone Businesses

3. Offshore Companies

Business Structures Comparison Table

| Feature | Mainland | Free Zone | Offshore |

|---|---|---|---|

| 100% Foreign Ownership | Yes (in most sectors) | Yes | Yes |

| Market Access | Local & UAE markets | Limited to Free Zone | No UAE market access |

| Geographic Base | Nationwide UAE | Industry-specific zones | Offshore operations |

| Tax Benefits | Low corporate tax (9%) above income of AED 375,000 | 0% personal tax. 0% corporate tax for qualifying persons and 9% on non-qualifying income of above AED 375,000 | No UAE taxation |

| Government Contracts | Eligible | Limited | Not eligible |

| Confidentiality | Moderate | Moderate | High |

| Ease of Setup | Normal | Simplified in zones | Simplified |

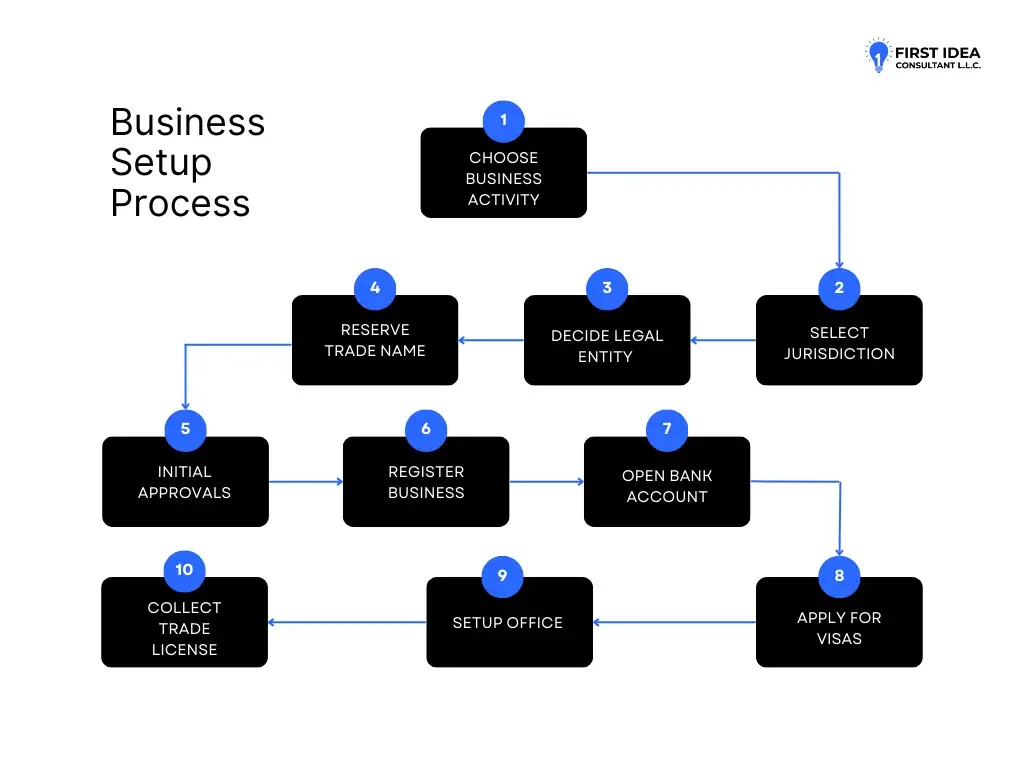

Step-by-Step Guide to Setting Up a Business in Dubai

1. Choose a Business Activity

2. Select the Right Jurisdiction

- Mainland gives you full access to UAE markets and the potential to work on government contracts.

- Free Zones cater to specific industries, offering tax incentives and 100% foreign ownership.

- Offshore is all about helping companies that want to operate globally, providing privacy and easier rules.

3. Decide on a Legal Entity Structure Jurisdiction

- Limited Liability Company (LLC): Perfect for most entrepreneurs, giving you flexibility and access to the local market.

- Sole Proprietorship or Civil Company: Ideal for professionals and freelancers in sectors like consultancy or services.

- Branch Office: Great for expanding an overseas brand into the UAE.

4. Reserve Your Trade Name

5. Apply for Initial Approvals

6. Register Your Business

7. Open a Corporate Bank Account

8. Apply for Visas

9. Set Up Office Space

10. Final Approval and Collect Your Trade License

Financial Considerations

Right—setting up a business in Dubai isn’t just about big dreams. It’s also about understanding the numbers. But don’t worry, I’ve got the breakdown for you. From costs to funding to tax rules, here’s everything you need to keep your finances in check while building your empire.

Estimated Costs for Setting Up

- Trade License Fees: AED 5,500 – AED 50,000 annually, depending on your business structure (Mainland licenses tend to cost more than Free Zone licenses).

- Office Space: A Free Zone virtual office can start at AED 5,000 per year, while a fully serviced physical office on the Mainland might set you back AED 20,000 – AED 50,000 annually.

- Visa Fees: AED 3,000 – AED 7,000 per visa, covering investor, employee, or dependent types.

- Miscellaneous Fees: Administrative charges, such as notarization of documents and registration, often range from AED 1,000 to AED 5,000.

Available Funding Options

- Self-Funding: AED 5,500 – AED 50,000 annually, depending on your business structure (Mainland licenses tend to cost more than Free Zone licenses).

- UAE-Based Grants: The UAE is big on innovation. Programs like the Mohamed Bin Rashid Innovation Fund (MBRIF) provide grants and loans for startups with scalable and creative ideas.

- Venture Capital & Angel Investors: Dubai is a hub for venture funding. With the city drawing in VCs worldwide, especially for tech startups, there’s no shortage of investors willing to back bold ideas.

Tax Implications

- Corporate Tax:Set to 9% on profits exceeding AED 375,000, this tax applies from June 2023 onward. The first AED 375,000 is untouched — great news for small businesses and startups.

- VAT:Mainland businesses must charge a 5% VAT on taxable supplies. Free Zone businesses, on the other hand, may enjoy exemptions based on the nature of their goods or services.

For entrepreneurs, these rates are some of the lowest globally, keeping operational costs competitive while still playing by the rules.

Ultimately, knowing your financial landscape isn’t just smart—it’s essential. Dubai’s mix of clear costs, accessible funding, and competitive tax policies makes it one of the most business-friendly cities in the world. Now, the question is—are you ready to make the numbers work for you? The opportunity’s waiting.

Legal and Regulatory Requirements

Understanding UAE Business Laws

Important Documentation

- Memorandum of Association (MoA): This document defines your company’s scope, ownership structure, and roles. It’s like your company’s constitution.

- Tenancy Contracts: Renting office space? You’ll need a notarized Ejari, the official tenancy contract registered with the Dubai Land Department.

- Trade Name Documents: Your business name approval, obtained earlier, must match your branding to avoid hiccups during registration.

Acquiring External Approvals

Intellectual Property Protection

Cultural and Business Etiquette

Importance of Adapting to Emirati Culture

Alright, so you’ve got your trade license in hand, your office space is secured, and the legalities are sorted. Fantastic! But here’s the thing—doing business in Dubai isn’t just about having the right documents. It’s also about understanding the culture and playing by the unspoken rules that dictate respect and trust. Crack this code, and you’ll unlock doors you didn’t even know existed.

- Modesty Reigns Supreme: When in Dubai, keep it classy. Whether it’s your business attire or your interactions, maintaining modesty is the key. Men should opt for suits, while women should ensure their clothing is professional and avoids being too revealing.

- Respect Religion: Fridays are the holy day in Islam, and public prayer times are sacred. Be mindful of holy months like Ramadan—no eating, drinking, or smoking in public during daylight hours out of respect for those fasting.

- Hospitality Matters: Know this about Emirati culture—it revolves around respect and generosity. When invited for tea or coffee, accept it. It’s not just a drink; it’s an introduction.

Building Business Relationships

- Leverage Personal Introductions: Word-of-mouth and strong connections go a long way. If you have a mutual contact, ask them to introduce you to key Emirati figures. This adds credibility to your approach.

- Use Networking Events: From exclusive business councils to trade expos, Dubai is buzzing with networking opportunities. Events by organizations like the Dubai Chamber of Commerce offer a chance to meet decision-makers in your industry.

- Get Patient, Get Persistent: Establishing trust doesn’t just happen in the first meeting. Be prepared to meet several times, exchange pleasantries, and patiently nurture the relationship before sealing a deal.

Common Etiquette in Meetings

- Greetings Matter: Start with a firm handshake while maintaining eye contact. If you’re doing business with locals, a slight nod of respect goes a long way. For women meeting Emirati men, a handshake may not always be offered—wait for them to extend their hand first.

- Be Punctual, but Flexible: While it’s crucial for you to arrive on time, don’t be surprised if the meeting starts late. UAE businesses often work on a flexible timeline, focusing more on the quality of the interaction than clock-watching.

- Build Rapport: Emirati culture places great importance on small talk. Don’t rush straight into business discussions. Ask about their family, work, or even their thoughts on Dubai’s latest developments—it’s all part of building trust.

Frequently asked questions

FAQ

Dubai’s economy is nothing short of dynamic. Whether you’re eyeing hospitality, tech, or trade, the city has a spot for you. But where are the real gold mines? (i) Import & Export: Imagine being at the beating heart of a $700 billion trade market. Dubai’s unparalleled location connects East and West, paired with a logistics network designed to make your competitors weep. If you’re not in it, you’re already behind. (ii) Cryptocurrency: Over 550 crypto startups aren’t here by accident. Dubai’s no rookie—it’s leading the crypto revolution with airtight regulations and cutting-edge infrastructure. Whether it’s mining, NFTs, or blockchain apps, this is where you plant your flag. (iii) AI and Smart City Tech: The UAE isn’t just adopting AI—it’s spending $20 billion to create the smartest, most connected city on the planet. From autonomous vehicles to AI-powered healthcare, this sector’s doors are wide open for those who want to make waves. (iv) Real Estate: The classics never fail. Real estate in Dubai means consistent action and mega-profits, whether you’re cashing in from towering developments like Dubai Creek Harbour or catering to the surging population. Investors are everywhere—so should you be. (v) Tourism & Hospitality: A $30 billion market that keeps growing. From luxury hotels to hyper-personalized travel, the opportunities here are golden. Dubai doesn’t just attract tourists—it makes sure they spend, and you can be the one collecting. (vi) Healthcare: Dubai’s MedTech rockets are taking off. Why? A massive push toward medical tourism, AI health solutions, and cutting-edge facilities. The profit potential? Practically unlimited for the savvy entrepreneur ready to ride this rising tide. (vii) E-Commerce: $17.2 billion in revenue by 2027? It’s not a prediction—it’s happening. From sustainable goods to niche marketplaces, if you can carve out a piece of the pie, it’ll taste sweeter than anywhere else in the world. (viii) Renewable Energy: Green is gold in Dubai. With $54 billion committed to sustainability and a bold mission to hit net zero by 2050, the renewable energy sector isn’t just a trend—it’s the future. The innovators cash in first; the hesitant watch from the sidelines. These aren’t just booming sectors; they’re golden ticket rides for anyone bold enough to strap in and take control. The question isn’t “should you invest?” It’s “how fast can you get started?”

Absolutely. You don’t have to pack your bags and move, but you might consider it once you see your business climb. As a foreign investor, you can set up your business remotely, especially in Free Zones. Many of these zones allow 100% foreign ownership, without requiring you to be physically present. However, you’ll need a local agent or service provider who can act on your behalf for administrative tasks, like acquiring licenses or renting office space. And guess what? You can monitor and run most operations digitally, thanks to Dubai’s world-class smart services.

Ah, the million-dirham question! Here’s how they stack up, side by side. Mainland: (i) Freedom to trade across Dubai and the UAE. (ii) Requires a physical office space. (iii) Allows government contracts—a big deal for industries like construction or logistics. (iv) May require a UAE national as a local sponsor, owning 51% of your company (unless the business qualifies for full foreign ownership under new laws). Free Zone: (i) 100% foreign ownership, no local sponsor required. (ii) Tax benefits galore—0% corporate and personal income tax for qualifying businesses. (iii) Ideal for export-oriented businesses or digital services. (iv) Limited to trading, services, or production within the Free Zone or internationally—not within the broader UAE market. Your choice depends on your business model. Want complete autonomy? Free Zone is your playground. Need access to UAE’s markets? Mainland is the ticket.

Think starting a business takes months? Not in Dubai. The city thrives on efficiency. For a Free Zone, the setup can take as little as 1–3 weeks, provided you’ve got your paperwork in order. Mainland business setup takes a bit longer—up to 3–5 weeks—due to the need for external approvals, tenancy contracts, and local sponsor arrangements (if applicable). Pro tip: The process speeds up if you work with a specialized business consultant. First Idea Consultant LLC experts know the landscape inside out and can shave days off the timeline.

Unless you’re selling snow to glaciers, chances are there’s a market for you in Dubai. The city’s economy spans a wide array of industries, and its business-friendly regulations make it a haven for entrepreneurs. Whether you’re in healthcare, IT, logistics, import-export, or even sustainability, Dubai rolls out the red carpet. With the UAE’s focus on digitization and clean energy (aiming for 50% renewable energy by 2050), there’s a growing demand for green solutions and tech innovations. Plus, niche markets like luxury retail and creative sectors are thriving, thanks to a diverse population with varied tastes and the tax-free income incentive for residents.

Final Thoughts

If you’ve got the drive to build, we’ve got the expertise to guide you. With tailored consultation services and a proven track record of helping hundreds of startups, we can turn your “what ifs” into a thriving business.

Start your entrepreneurial journey today. Don’t just dream about success—take the steps to make it happen. Reach out to our team for a free consultation, and we’ll turn your business goals into reality.

Your story starts here, in the heart of Dubai. It’s time to make it unforgettable.